Although most of us don’t like thinking about it, death is a natural and unavoidable part of life. No one knows when their time will come, so it’s important to prepare for your death early, especially if you will be leaving behind loved ones.

If you are unsure what exactly you need to do to ensure your estate and other wishes are taken care of upon your death, continue reading for some helpful advice.

Make your funeral arrangements in advance.

Table of Contents

When a person dies, their loved ones are often left with a lot of questions about what to do with their estate. This includes decisions about what to do with the deceased’s body. To ease this burden on your loved ones, you can plan all arrangements for your funeral and body before your death. As long as you make plans with a trusted funeral service, your wishes will be honored upon your passing.

There are a few different options for what to do with a deceased person’s body. One option is to have a funeral and bury the body. This is often the most expensive option, and it can take a long time to plan. Another option is cremation, which is often cheaper than a funeral and burial and can be done relatively quickly. However, there are some important things to keep in mind when choosing cremation. For example, you will need to decide what to do with the ashes. You can choose to bury them, scatter them, or keep them in an urn.

If you are not sure what you want to be done with your body upon your passing, or if you are looking for information on cremation cost, please contact a funeral home. They can help you make the right decision for yourself and your loved ones.

Get all of your finances in order.

One of the biggest obstacles for loved ones grieving the loss of a beloved family member is the financial mess that is often left behind. To make things easier for your loved ones in terms of your finances, the most important thing is to start early.

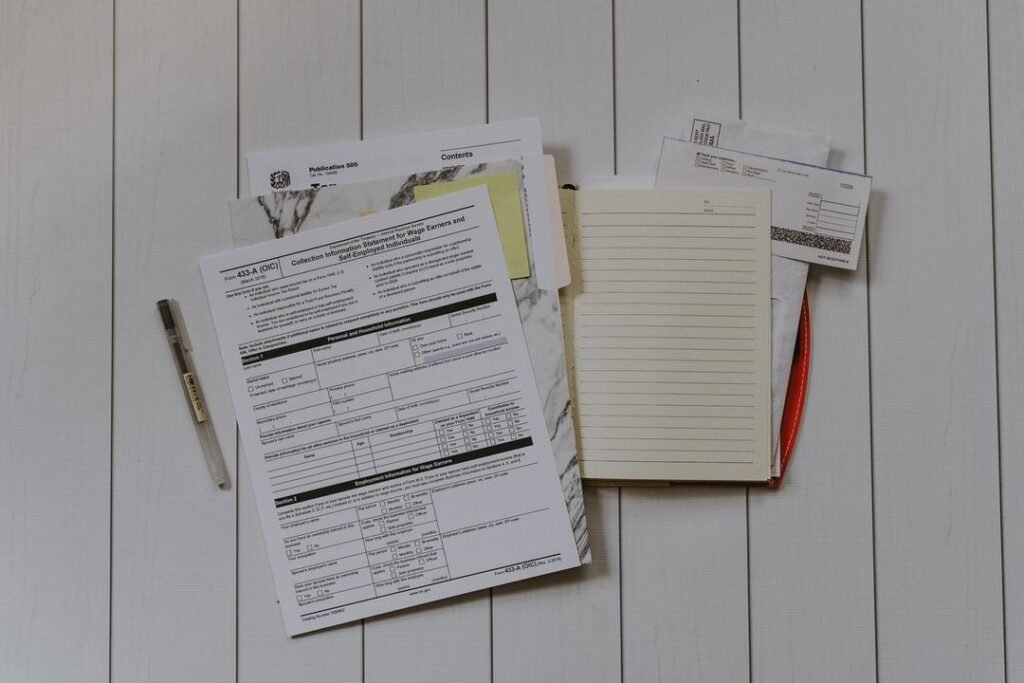

One of your biggest financial tasks is to file your estate taxes and make sure to stay on top of them every year. It’s important to file these taxes on time to avoid penalties that may fall on your loved ones after your passing. To keep everything organized and clear so that any new person can make sense of your tax documents, invest in tax folders with foil stamping and clear labels. You might also want to invest in other tax supplies and pocket folders to manage all of your important documents.

Make plans for the future of your estate.

You don’t want to wait until you’re on your deathbed to start thinking about your estate. The earlier you start planning, the more options and the more time you’ll have to make sure everything is in order.

To get started, make a list of your assets and liabilities. You need to know what you own and what you owe in order to make informed decisions about what to do with your estate. Then, if you already have a will and estate plan, review it and make sure it still reflects your current wishes. If you don’t have a will, now is the time to create one. Next, if you have specific questions about your estate, it’s a good idea to meet with an estate-planning lawyer. They can help you figure out what steps you need to take to get your estate in order.

One of the most important decisions you’ll make when planning your estate is who will inherit your assets. Make a list of your beneficiaries and make sure they are aware of your plans. If you want to ensure that your assets are distributed according to your wishes, you may want to set up a trust. A trust can provide a lot of flexibility in how your assets are distributed. You will also need to choose an executor, who will be responsible for carrying out your wishes after your death. It’s important to choose someone you trust who is capable of handling this responsibility. Finally, make sure your life insurance policies and other insurance policies are up to date and reflect your current wishes.

These are just a few things you need to prepare before your death. Every individual’s situation is different, so make sure to talk to an estate-planning lawyer to get specific advice for your situation.